- Terra Classic topped all other altcoins with a surge in social engagements and mentions

- Despite a massive rise in burn actively, LUNC's momentum edged closer to bearishness

Terra Classic [LUNC] topped the altcoin market on 3 December with regards to its social activity. According to LunarCrush, the social intelligence tracking platform, LUNC had its ever-ready community to thank for the milestone.

Read Terra Classic's [LUNC] Price Prediction 2023-2024

The breakdown of the details showed that social contribution formed 12.19% while engagements accounted for 71.3%. This surge indicated that there was a reawakening of activities across social platforms from the LUNC tent.

Take all the tokens, burn it up

The token hitting such heights might be connected to the recent landmark hit with LUNC's burn activity. As of 1 December, LUNC burn hit an unprecedented 6,389,633,879 — a 972,516% increase.

According to some sections of the LUNC community, Binance, who backed the burn system, could have contributed to the spike. However, the momentum seemed to have dipped, as LunaBurnTracker revealed that there had been a 100% decrease to 3,167,134 LUNC in the last 24 hours.

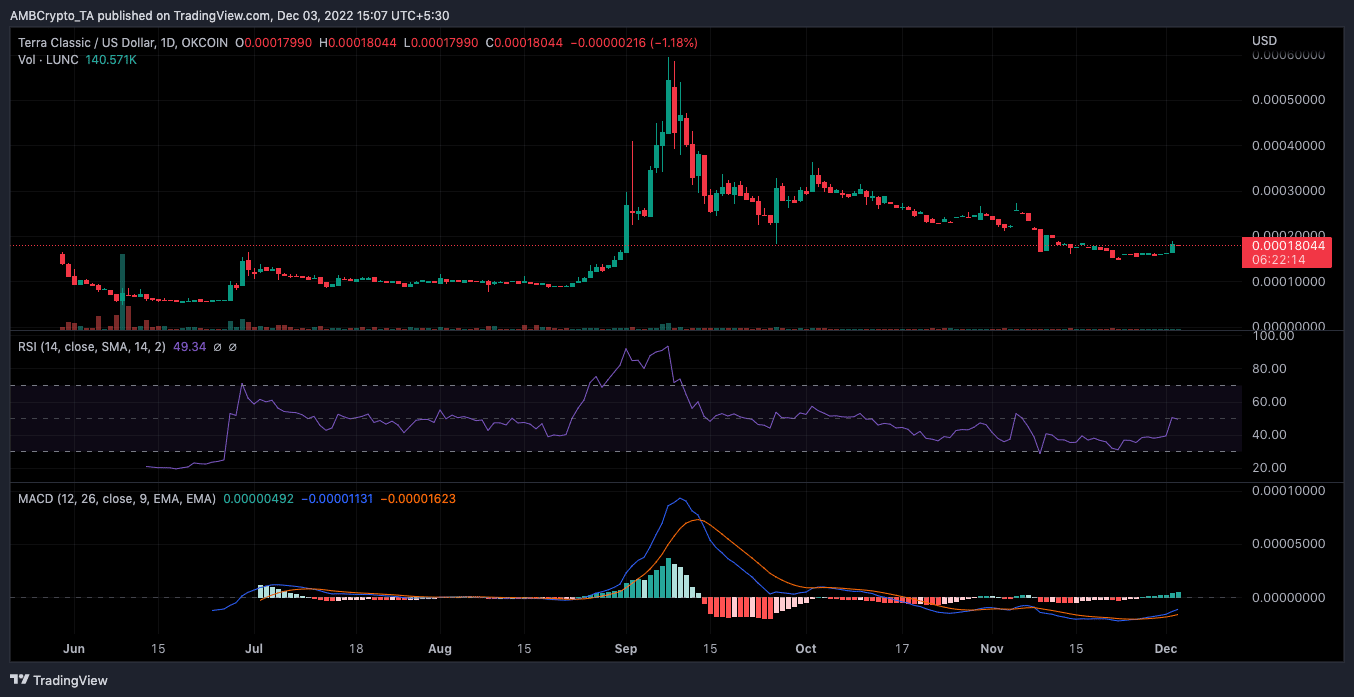

As for its price, LUNC did not react positively to the update. At press time, LUNC exchanged hands at $0.000179. This was a 2.20% decline from the value on 2 December. On the contrary, its performance in the last seven days increased by 10.67%, according to CoinMarketCap. In addition, the uptick enabled the token to retrieve a $1 billion market cap.

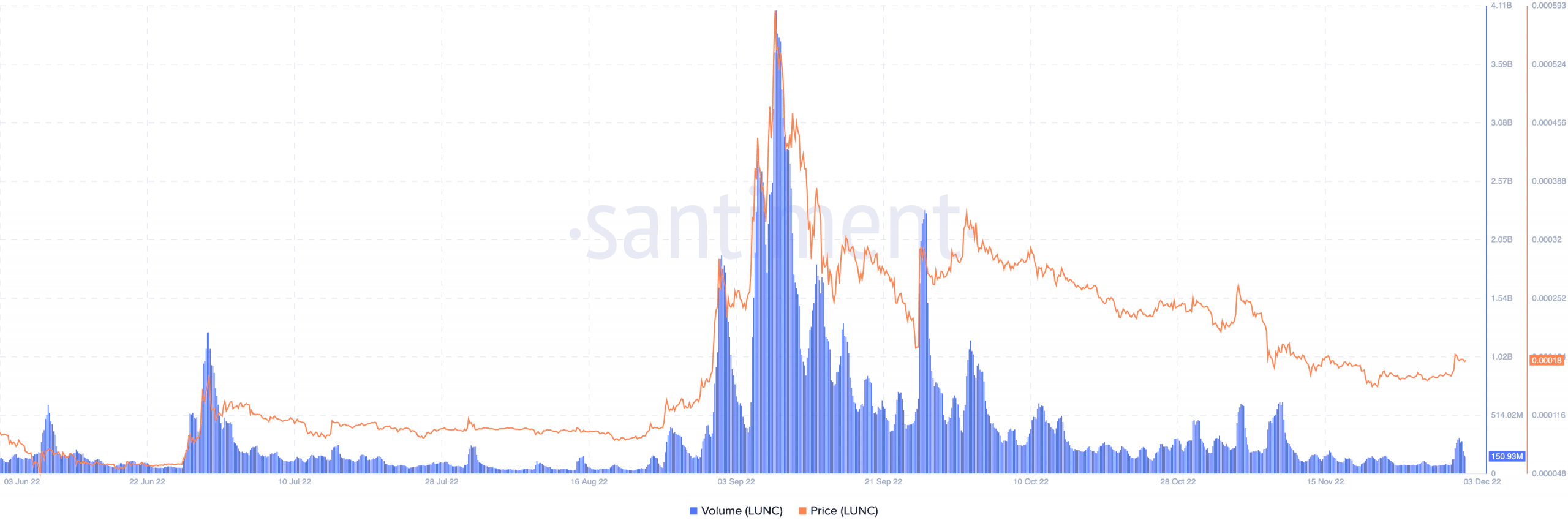

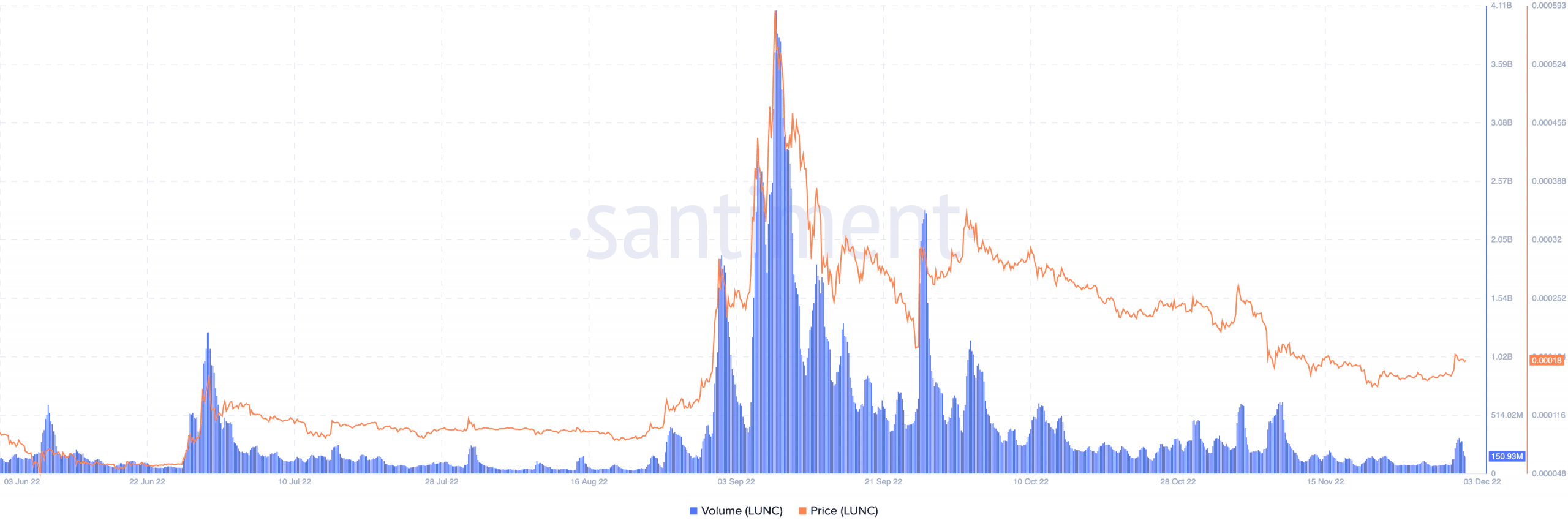

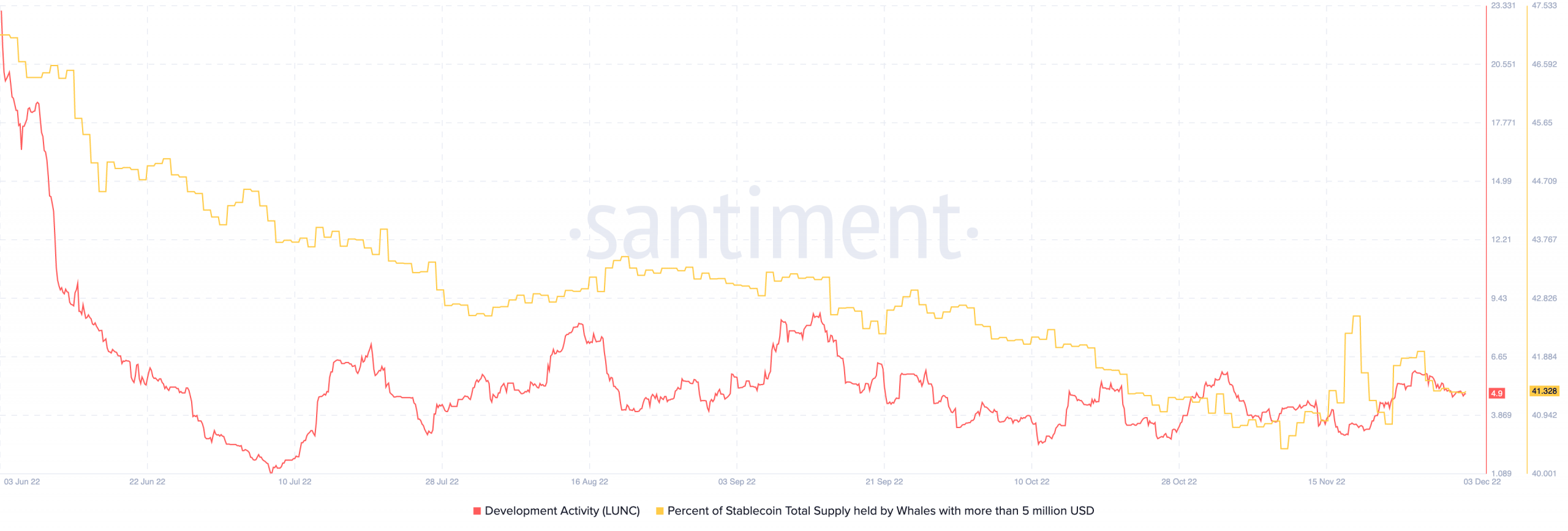

As of this writing, LUNC's market cap was $1.07 billion. However, it was not the same as the volume. According to Santiment data, its volume had declined 44.86% in the last 24 hours. Considering the decrease, it meant that LUNC investors had refrained from increased participation in transactions on the network.

Source: Santiment

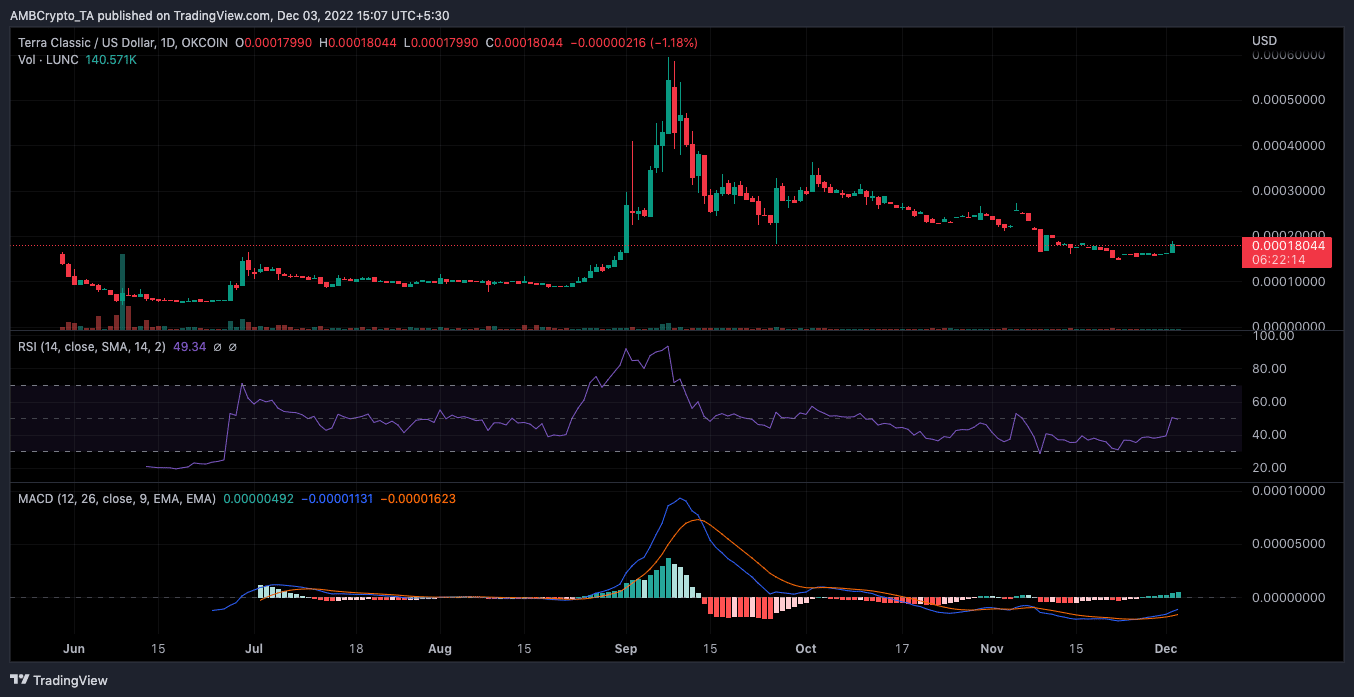

Per price action, LUNC had relatively good momentum. As of this writing, the Relative Strength Index (RSI) was at 49.34. This signified a neutral ground, as LUNC was neither oversold nor overbought.

For the Moving Average Convergence Divergence (MACD), it was a heated contest between buyers and sellers. Based on the daily chart revelations, buyer and seller strength was below the zero-point histogram. This indicated a bearish momentum. However, the MACD being at 0.00000492 on the positive axis meant that buyers had some potential to regain control.

Source: TradingView

Enhancements down

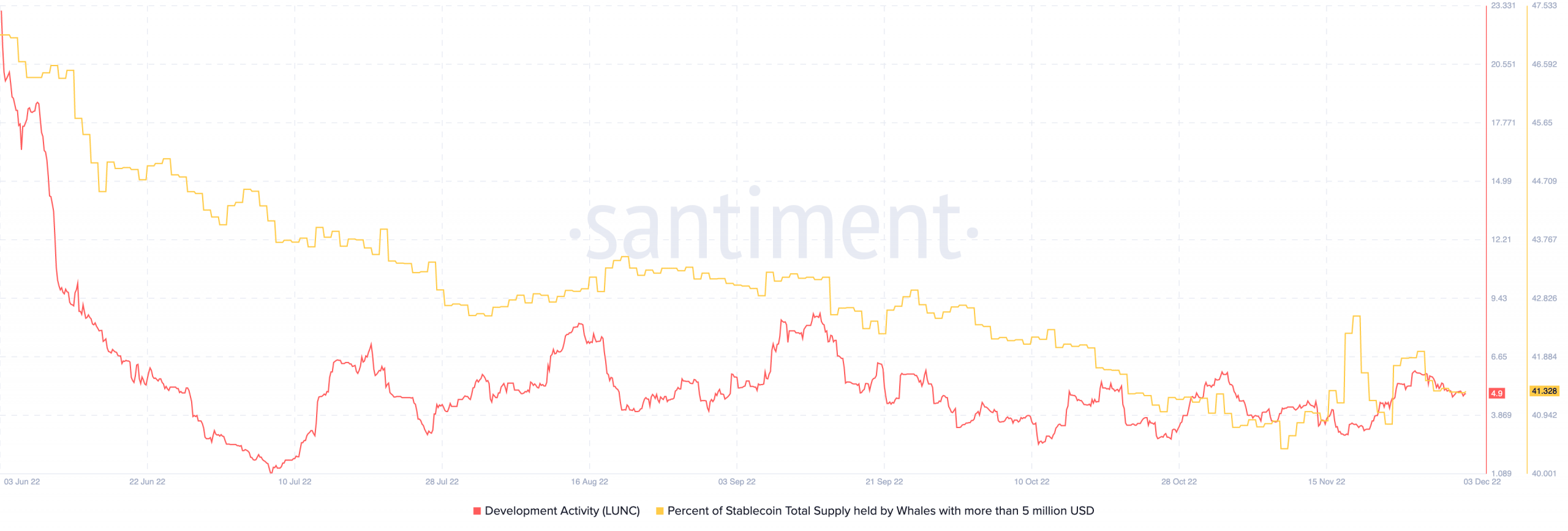

In the case of its development, Santiment revealed that LUNC towed towards the downside. According to the on-chain information platform, LUNC's development activity was down to 49.34.

In the meantime, it meant that the Terra developers were not actively making noteworthy upgrades to the network. For whales, this was no time to add to their holding as the supply held decreased to 41.328.

Source: Santiment

. Let's take a look at today's social activity

. Let's take a look at today's social activity  .

.  of 1 out of the top 4,023 coins across the market.

of 1 out of the top 4,023 coins across the market. -100% decrease. 33 burns @ 2 BPH. 1 LUNC = $0.00017959

-100% decrease. 33 burns @ 2 BPH. 1 LUNC = $0.00017959

No comments:

Post a Comment