Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer's opinion.

- The trend and structure of MATIC were bearish.

- A plunge beneath the bullish order block will present selling opportunities on a retest.

The crypto market has witnessed volatility in both directions over the past month. Bitcoin [BTC] saw a drop from $24k to $21.6k in early February, followed by a rally to $25.2k in mid-February. The fate of the native token of Polygon [MATIC] was more volatile, but its trend remained upward on the higher timeframes.

Read Polygon's [MATIC] Price Prediction 2023-24

An analysis of lower timeframe charts showed bearish momentum was dominant. However, MATIC was headed into a zone of support on the charts. If Bitcoin saw bulls take control, MATIC could perform well over the next week as well.

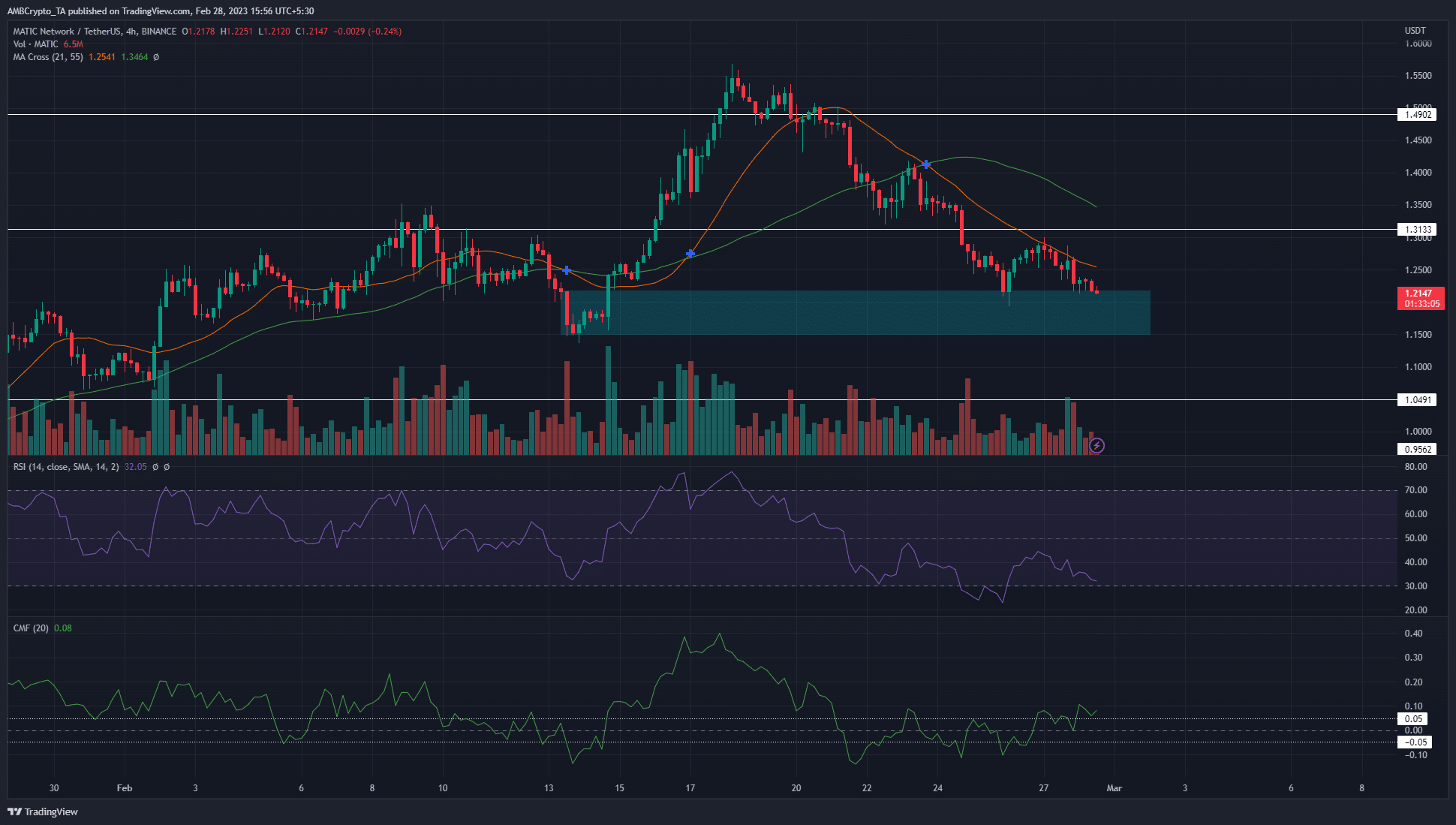

The $1.15 region saw a strong H4 bullish order block

Source: MATIC/USDT on TradingView

The order block was highlighted in cyan. Since 2 February, the $1.17-$1.2 area acted as strong support for MATIC. On 13 February, the price descended beneath this area to reach as low as $1.136 but quickly rebounded.

The strong move upward marked it as a significant zone. The slow retracement over the past two weeks gave the buyers time to accumulate before the next push higher. Hence, over the next few days, a bullish reversal can be expected based solely on price action.

Regardless, the momentum indicators continued to show stiff bearish pressure. The 21 and 55-period moving averages showed downward momentum was in force, while the RSI was also beneath neutral 50. It has been beneath neutral 50 since MATIC's drop beneath the $1.42 mark.

Hence, risk-averse traders can wait for a definite shift in trend before buying. Meanwhile, the CMF continued to climb upward over the past few days to show a flow of capital into the market.

Open Interest was flat but funding rate saw a shift

The one-hour chart on Coinalyze showed Open Interest behind MATIC was falling over the past few days. Since 24 February, the price has tested the $1.3 area as resistance. Yet, each time the price tested this zone as resistance, the Open Interest continued to slump.

Realistic or not, here's MATIC's market cap in BTC's terms

Therefore, long positions were discouraged, and the sentiment remained bearish on the lower timeframes. In contrast to this finding, the funding rate flipped positive in recent hours, which suggested a shift in momentum.

On 27 February, $300k worth of short positions were liquidated when MATIC rallied from $1.23 to $1.28, which highlighted the importance of caution on weekends.

No comments:

Post a Comment