Bitcoin price had previously been showing extreme strength leading up until the debut of the first spot ETFs. That strength has since subsided, leading to a 20% correction in BTCUSD.

A popular technical indicator that measures momentum, however, could point to powerful continuation to the upside, but only if a certain level is breached. Keep reading to learn more about the Relative Strength Index and how the top cryptocurrency behaves once the market reaches an "overbought" level.

Bitcoin Approaches "Overbought" And Why This Isn't A Bad Thing

The Relative Strength Index is a momentum-measuring tool that signals when a market is "overbought" or "oversold". When a financial asset reaches such conditions, it often means the trend is about to change.

In Bitcoin and other cryptocurrencies, the weekly RSI is often a signal that the asset is moving into its most powerful phase. For example, Bitcoin made it above a reading of 70 in October 2023, and only weeks later saw an over 60% rally to local 2024 highs.

Now 1W BTCUSD charts are showing an RSI reading of just below 70, pointing to a possible close back above the overbought level. If bulls can keep the top cryptocurrency by market cap above $43,650, the weekly RSI should close above the threshold.

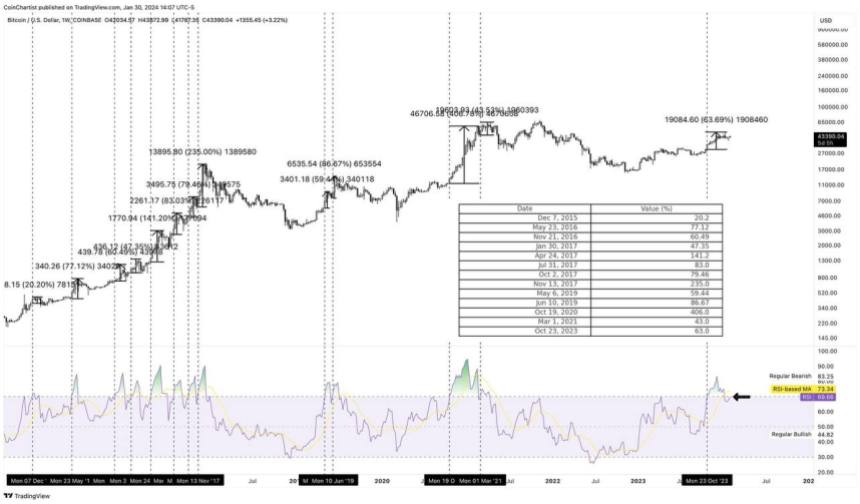

The average move is 107% | BTCUSD on TradingView.com

BTCUSD Historical 1W Relative Strength Data

Historical data could possibly shed some light on what might happen if the weekly Relative Strength Index gets the close above 70 as anticipated.

Over the last ten years, Bitcoin saw a 1W RSI close above 70 a total of 13 times. This happened 8 times in 2016 and 2017, twice in 2019, and once each in 2020 and 2021. One additional instance occurred in 2023.

Of the 13 times, the average gain after the RSI closed above 70 to the peak of the movement was 107%. The largest rally was in 2020, bringing over 400% returns. The smallest rally was in 2016 and saw only a 20% gain.

After removing the largest and smallest outliers, the average drops down to around 61%. This could mean that Bitcoin could produce on average a move between 61 and 107%.

A 61% gain takes BTCUSD back to just under $68,000 and shy of a new all-time high, while a 107% move sets a new record closer to $90,000 per coin. The cryptocurrency is also potentially working on a bull flag pattern, with a target of around $77,000.

The 75% target is within historical averages | BTCUSD on TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source: NewsBTC.com

No comments:

Post a Comment