BNB was on fire over the last few days as its high burn rate attracted the crypto community. During the last seven days, BNB tokens worth $574,800,583.92 were burnt. To date, over 42 million tokens have been burnt, which reflects BNB's efforts to support the token's deflationary characteristics.

_____________________________________________________________________________________

Here AMBCrypto's Price Prediction for BNB for 2023-2024

_____________________________________________________________________________________

Furthermore, BNB also launched a DeFi Savings account by combining staking and offering liquidity in a single-sided BNBx pool. The BNB DeFi Savings account seeks to provide consumers with a low-risk method of earning an income on their BNB without a lockup.

What's up with BNB's NFT space?

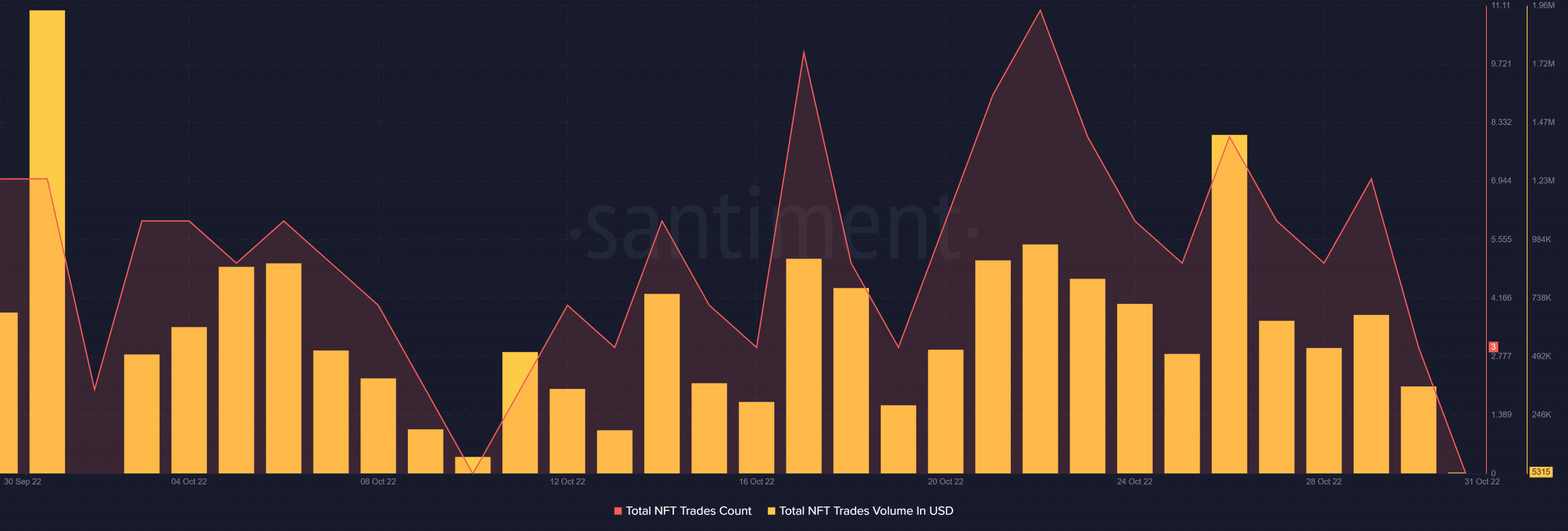

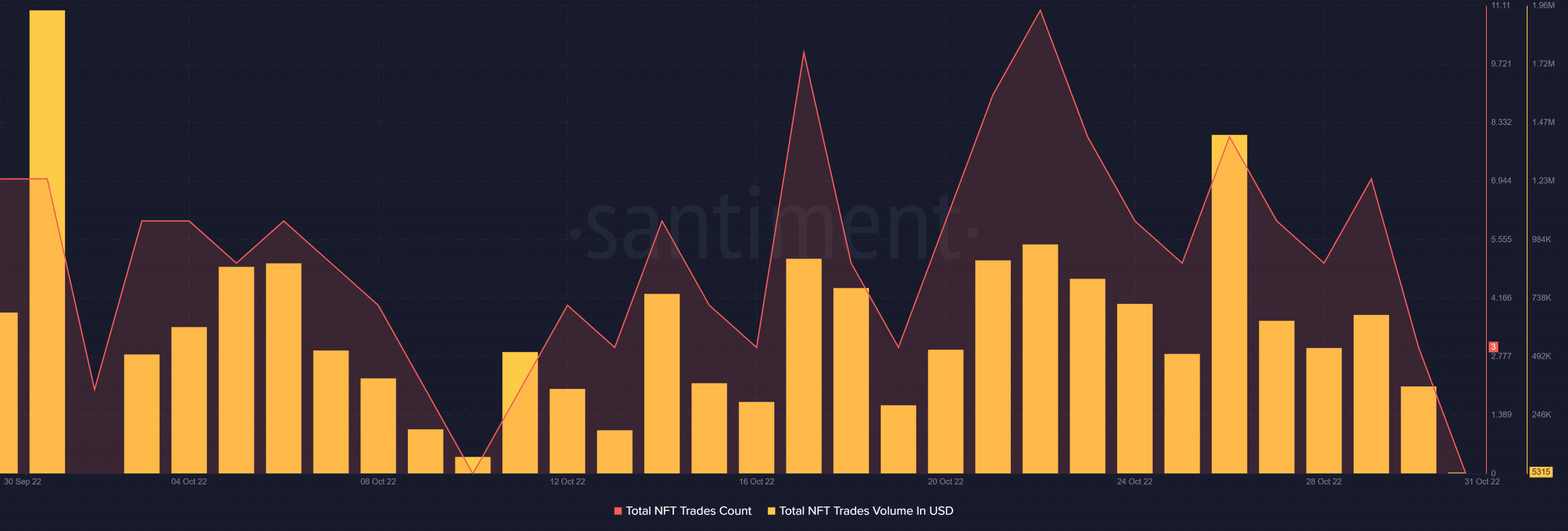

Apart from the aforementioned developments, BNB's NFT ecosystem also witnessed some traction last month. Santiment's data revealed that BNB's total NFT trade volume in USD also spiked last month. This reflected the growth of the BNB NFT ecosystem. According to Rareboard, PancakeSwap and Tofu NFT had the highest market share in BNB Chain's NFT space.

Source: Santiment

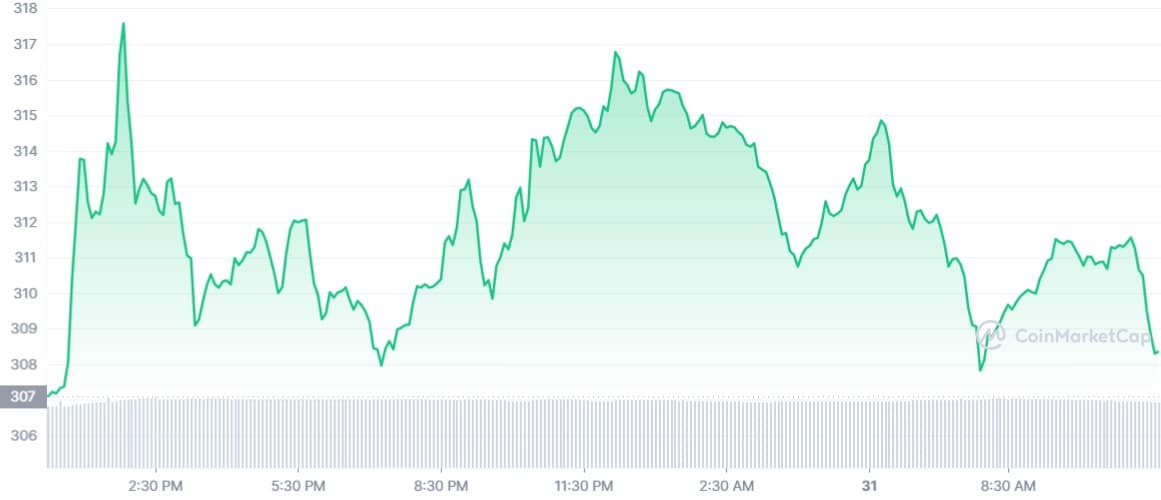

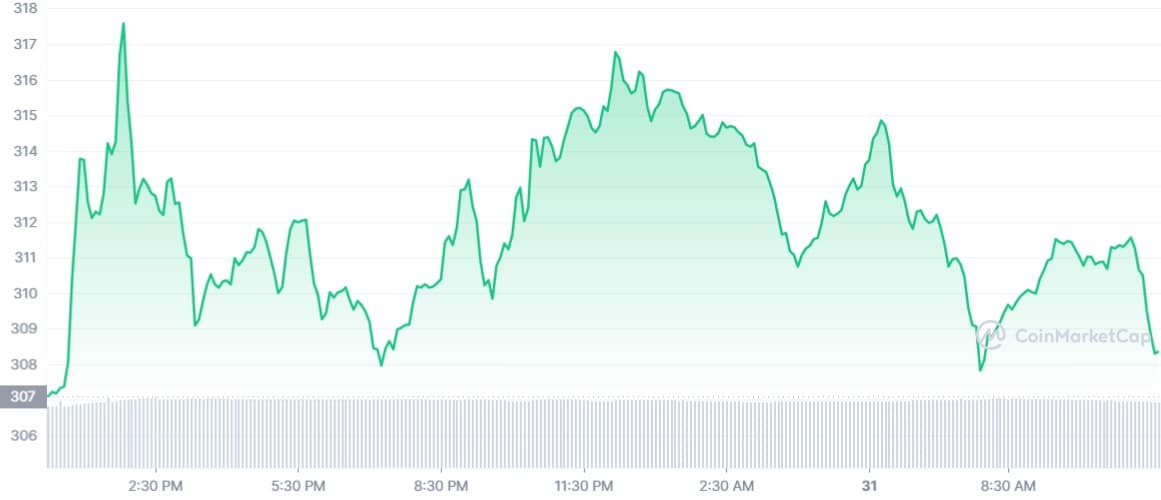

Interestingly, BNB's price action also witnessed some promising growth as it registered over 13% weekly gains. At the time of writing, BNB was trading at $308.30 with a market capitalization of over $49.3 billion.

Though the bulls seemed to have an advantage in the crypto market, things might turn around soon for BNB, as suggested by several on-chain metrics.

Source: CoinMarketCap

Caution is recommended

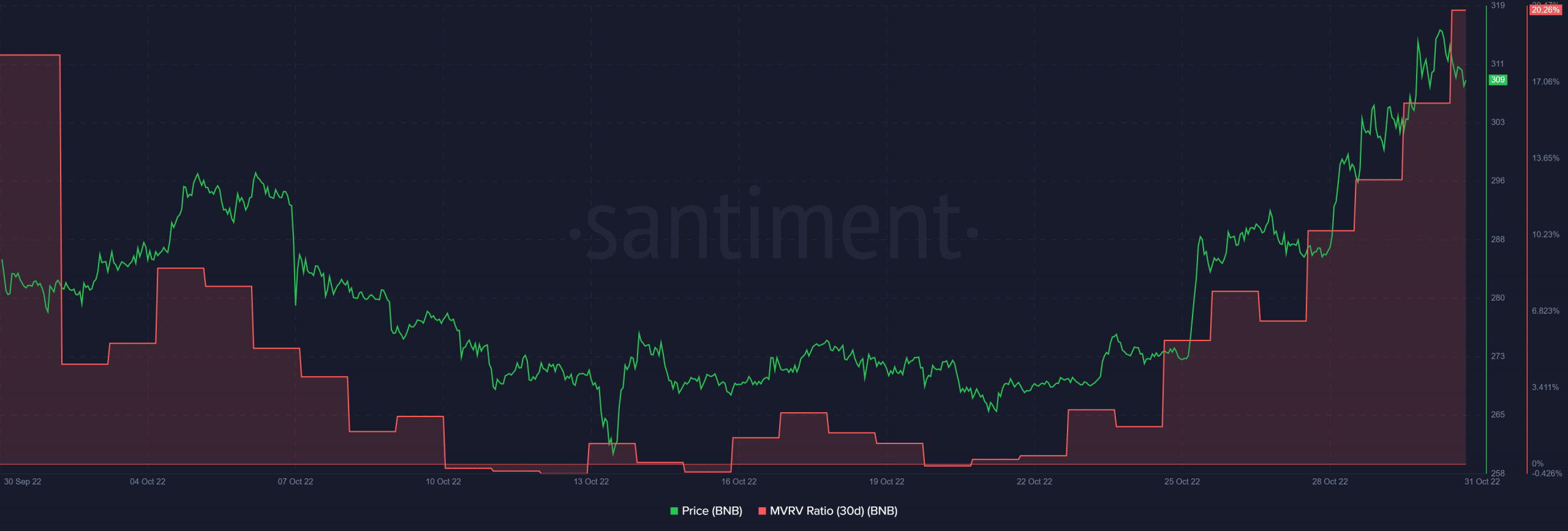

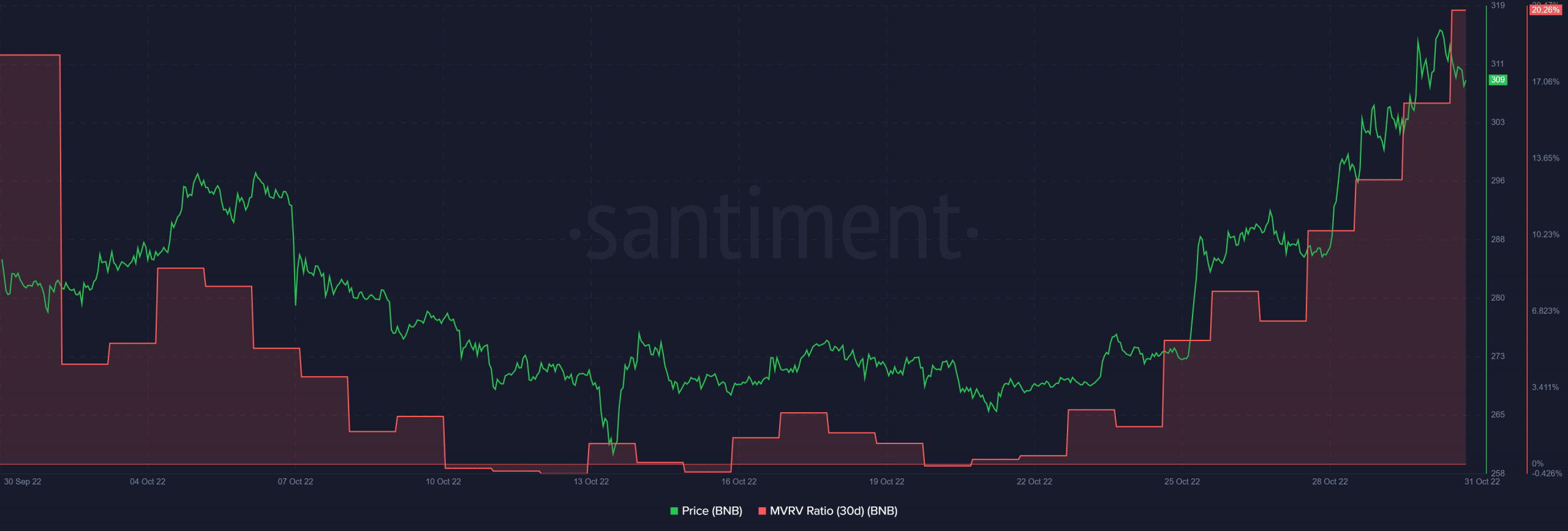

CryptoQuant's data revealed that BNB's price was in an overbought position, indicating a trend reversal in the coming days. Furthermore, BNB's Market Value to Realized Value (MVRV) Ratio skyrocketed recently, which might be a possible market top indicator, increasing the chances of a price plummet.

Source: Santiment

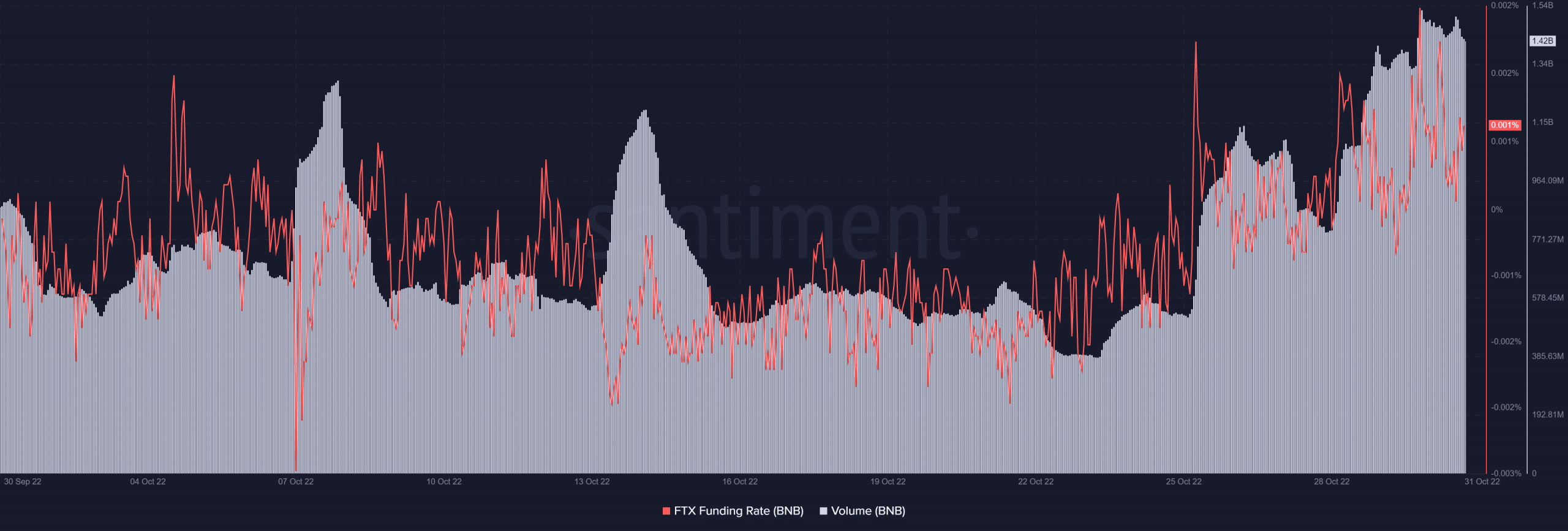

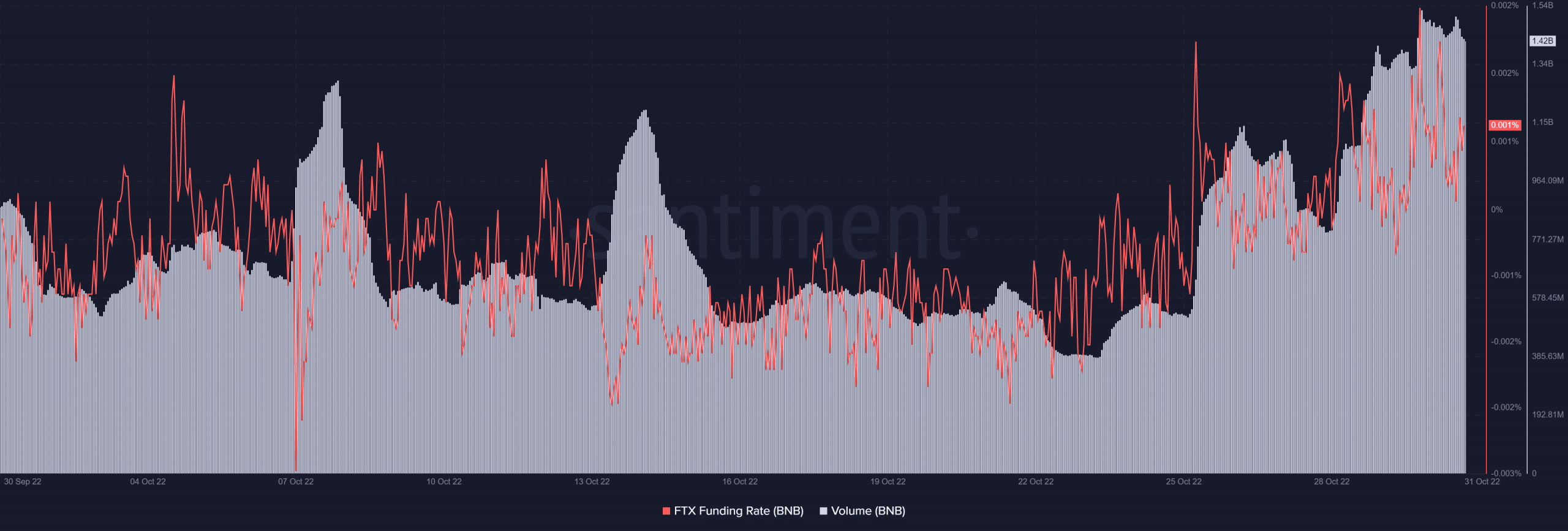

However, a few of the metrics were also working in favor of BNB, providing some relief to the investors. For instance, BNB's FTX funding rate went up over the last few days, reflecting higher interest from the derivatives market. Moreover, BNB's volume also went up recently, which was a positive signal amidst the price surge.

Source: Santiment

BNB DeFi Savings Account

BNB DeFi Savings Account

No comments:

Post a Comment